Best ways to earn passive income

In a world where financial independence is increasingly intertwined with the pursuit of a fulfilling life,the concept of passive income has emerged as a beacon of hope for many. It whispers promises of earning money while you sleep, giving you the freedom too explore passions, spend time with loved ones, or simply enjoy the serenity of life’s little moments. But how does one weave this enchanting tapestry of income streams? Whether you’re a seasoned investor or just beginning your journey into the realm of finance, the allure of passive income lies in its potential to transform your financial landscape. In this article, we will delve into the best methods to cultivate and nurture passive income, guiding you through a variety of avenues that can enhance your wealth without the constant hustle and bustle of customary work. Join us as we explore these pathways to financial freedom—your future self will thank you.

Table of Contents

- Exploring Diverse Investment Avenues for Passive Income Growth

- Harnessing the Power of real Estate: Strategies for Long-Term Gains

- Utilizing Digital Platforms: Creating Income through Online Assets

- Building a Portfolio of Dividend Stocks for Financial Independence

- In Conclusion

Exploring Diverse Investment Avenues for Passive Income Growth

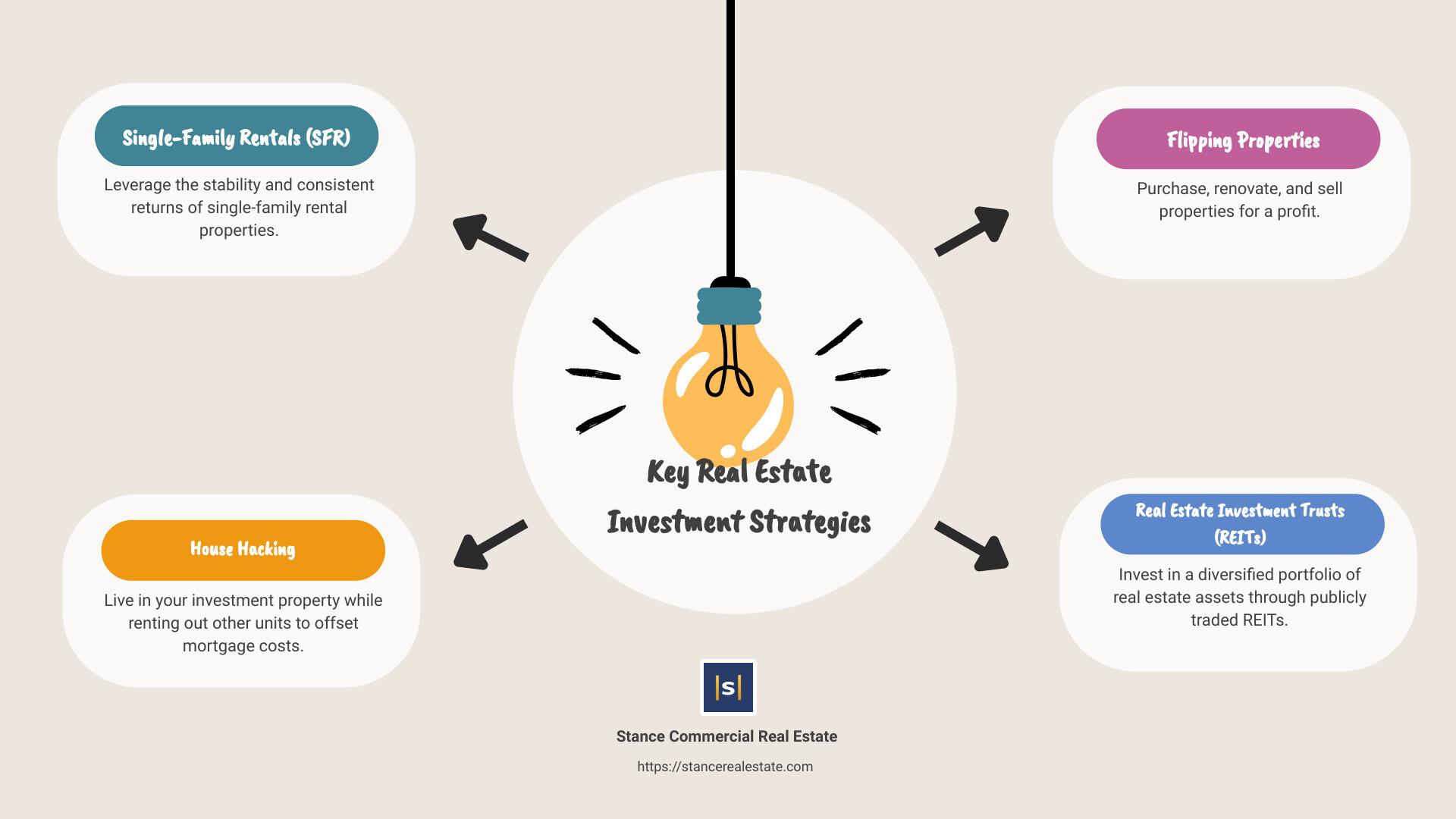

in the quest for financial freedom, diversifying income streams can significantly enhance your economic stability. One of the most appealing ways to achieve this is by venturing into real estate investments, which can provide both immediate rental income and long-term recognition. Consider options such as:

- REITs (Real Estate Investment Trusts): These allow you to invest in real estate without directly owning property.

- Rental Properties: Owning single-family homes or multi-family units can yield a steady cash flow.

- Real estate Crowdfunding: Pool your resources with other investors to back larger projects.

Another fertile area to cultivate is financial markets, where multiple instruments can generate passive income while allowing you to maintain versatility with investments. Some popular routes include:

- Dividend Stocks: Invest in companies that regularly distribute profits to shareholders.

- Bonds: Consider options like municipal or corporate bonds for fixed interest payments over time.

- Funds: Mutual funds and ETFs that focus on dividends or income-generating assets offer diversified risk and steady returns.

| Investment Type | Potential Returns | Risk Level |

|---|---|---|

| REITs | 6-10% | Medium |

| Dividend Stocks | 2-5% | Medium to High |

| Bonds | 1-4% | Low to Medium |

Harnessing the Power of Real Estate: Strategies for Long-Term Gains

Investing in real estate offers a fertile ground for those seeking to cultivate long-term financial growth. Among the most effective strategies is the acquisition of rental properties, where consistent cash flow can be generated through leasing. this method not only secures regular income but also allows for property value appreciation over time. Consider the following approaches to maximize your rental income potential:

- Location Analysis: Focus on properties in high-demand areas to ensure lower vacancy rates.

- Property Management: Hire a reputable management company to maintain the property and handle tenant relations efficiently.

- Value-Added Improvements: Invest in renovations that enhance property appeal and justify higher rents.

Another strategy is to explore real estate investment trusts (REITs), which provide an avenue for earning passive income without the hassle of direct property management. investing in REITs can yield substantial dividends, enabling investors to benefit from diversified real estate portfolios. Here’s a rapid comparison of common types of real estate investments:

| Type | Pros | Cons |

|---|---|---|

| Direct ownership | Control over property, rental income | Requires critically important capital, management needed |

| REITs | Liquidity, diversification, passive income | Market volatility, less control |

| Real Estate Crowdfunding | Low barrier to entry, access to larger deals | Fees may apply, limited liquidity |

Utilizing Digital Platforms: Creating income through Online Assets

In today’s digital landscape, the potential for creating income streams through online assets is greater than ever. By harnessing the power of various digital platforms, individuals can tap into opportunities that yield passive income with minimal ongoing effort. Affiliate marketing, for instance, allows content creators to promote products and earn commissions on sales made through their unique referral links.By building a niche website or a blog, one can attract a specific audience and strategically incorporate affiliate links, resulting in an income flow that can persist long after the initial content is published.

Another viable option is to generate revenue through digital products such as e-books, online courses, or stock photography. These assets not only fulfill a growing demand for knowledge and creativity but also allow sellers to reach a global market. Once created, these products can be sold indefinitely, providing a continuous stream of income with little upkeep. You might consider the following platforms to successfully launch your digital products:

| platform | Potential Income Generation | Best For |

|---|---|---|

| Amazon Kindle | Royalties on e-book sales | Writers and authors |

| Udemy | Course fees | Educators and experts |

| Shutterstock | Sales from photo downloads | Photographers and designers |

With the right strategy and dedication, digital platforms not only amplify your reach but also cultivate a lasting source of passive income. By continuously updating your assets and engaging with your audience, you can enjoy the benefits of online income without sacrificing significant time or resources.

Building a Portfolio of Dividend Stocks for Financial Independence

Investing in dividend stocks is a strategic way to create a reliable income stream that can contribute significantly to financial independence. First, it’s essential to identify companies with a strong history of dividend payments and increasing payouts over time. Look for stocks that offer attractive dividend yields, solid fundamentals, and a sustainable payout ratio. Concentrating on sectors such as utilities, consumer staples, and healthcare often yields stable dividends due to their consistent cash flow generation.Building a diversified portfolio across these sectors can mitigate risks while maximizing income potential.

to effectively manage a dividend stock portfolio, consider the following key principles:

- Reinvest Dividends: Utilize a Dividend Reinvestment Plan (DRIP) to automatically reinvest your dividends, compounding your returns over time.

- Assess Growth Potential: Beyond the current yield,focus on companies with a history of dividend growth,which can keep pace with inflation.

- Monitor Economic Trends: Stay informed about macroeconomic factors that may impact dividend sustainability and sector performance.

| Company | Dividend yield | 5-Year Dividend Growth Rate |

|---|---|---|

| Company A | 4.2% | 8.5% |

| Company B | 3.6% | 10.1% |

| Company C | 5.1% | 6.3% |

in summary

As we conclude our exploration of the best ways to earn passive income, it’s clear that the path to financial freedom is as varied as the individuals who walk it. from real estate investments that build equity over time to digital products that can be sold continuously, the opportunities are boundless. It’s essential to choose avenues that resonate with your interests and financial goals, cultivating a steady income stream that aligns with your lifestyle.

Remember, passive income isn’t about quick riches; it’s about setting up reliable systems that work in the background, allowing you the freedom to focus on what truly matters to you. As you embark on this journey, keep educating yourself, remain patient, and be open to adapting your strategies.

Ultimately, the best decisions for your financial future will spring from careful consideration and a willingness to take calculated risks. So take that first step today—your future self will thank you.